QR-code payments have the potential to replace any other form of mobile payment according to new research.

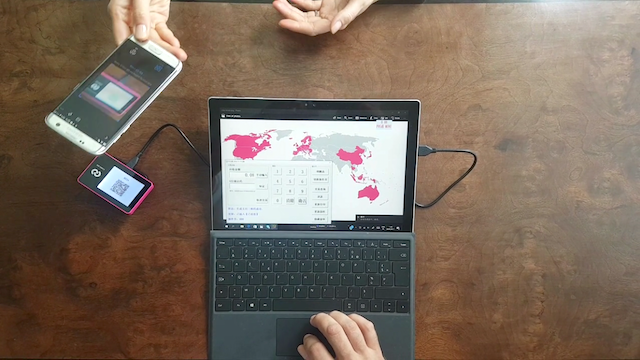

More than 1000 Chinese consumers and 60 decision-makers from global merchant companies were surveyed by mobile payments specialist Cancan and financial research company Kapronasia for the first global study covering the impact of Asian mobile POS payments worldwide.

“Alipay and WeChat Pay, both based on QR code technology, are already dwarfing their Western counterparts tenfold with 750 million active users between them,” says Cancan MD Candice Koo.

She says global merchants need to meet shoppers’ expectations regarding mobile payments. “Today that consumer is predominantly Chinese, but in year we could also be looking at Indians, Indonesians, Japanese and Koreans, who are already all following the Chinese trajectory.”

“The rapid adoption of mobile payments by Chinese consumers domestically is well known, but not as much how they are using them abroad,” says Kapronasia director Zennon Kapron.

The 2017 Mobile Payment Survey: Chinese Consumers Abroad investigates how mobile payments methods such as Alipay and WeChat Pay are shaping Chinese consumer expectations toward shopping outside of China. It also investigates global merchant preparation for this phenomenon.

Key findings include:

- Mainland Chinese consumers expect to spend more with mobile payments this year and next when travelling abroad, overriding the use of cash or credit cards

- Nearly half of the consumers surveyed made between 10 and 30 per cent of their overseas shopping purchases with QR-code mobile payment methods; one-third paid for more than half their purchases in China with mobile

- Fashion and cosmetics/skincare products are the categories most likely to attract mobile payment purchases

- Consumers chose mobile payments for transaction convenience and the ability to track purchases in real time; they also appreciate not needing to carry cash and credit cards while travelling

- More than a third of merchants who accept mobile payments say this payment method contributes to at least 3 per cent of their global sales, with some merchants experiencing a share as high as 25 per cent.

The report says customer demand is driving merchant adoption of mobile payments, while merchants are attracted by the speed of mobile-payment transactions.