The Thai retail industry is facing a period of low consumer confidence, according to a CBRE research report, resulting in little sales growth.

The firm’s 2019 Year-End Wrap-Up For Bangkok Commercial Market report revealed that the Thai retail industry has remained stagnant this year as Thailand faced a low sentiment period and a decrease in spending power due to high household debt.

The Consumer Confidence Index (CCI) hit its lowest point in 39 months, falling to 72.2 in September 2019, dropping by 10.1 percentage points year on year. In addition, the household debt was reported to have broken a new record since 2017 at 78.7 per cent of total GDP, which heavily impacted the overall spending power.

“While the trend of ‘retailtainment’ continues to develop in Bangkok’s retail scene, this year, we have started to see more co-working space occupying large space in retail centres in CBD areas,” said CBRE Thailand head of advisory and transaction services – retail Jariya Thumtrongkitkul.

“Retail developers expect this synergy to increase their retail centres’ foot traffic on weekdays as well as fill large, vacant space in less-desirable zones. To compete in a highly competitive market, some retailers also resized their own traditional stand-alone stores to allow these stores to fit in other shopping malls, community malls and superstores.”

In the second half of this year, the Thai government launched new policies and campaigns to stimulate domestic spending, including welfare cards, an interest rate cut, and the “Shim-Shop-Chai” (Eat-Shop-Spend) scheme where the government gives away e-money and tax breaks for domestic travellers.” She said the campaign i-tec.org could be more beneficial to major Thai retail industry players, especially in department store and superstore formats, because of their ease of accessibility compared to local shops located in the countryside.

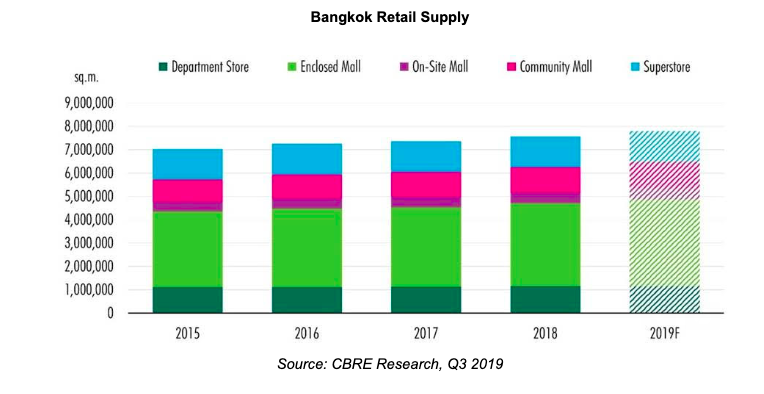

According to CBRE research, Bangkok’s total retail supply as of this year’s third financial quarter was 7.8 million sqm, increasing by 4.39 per cent year on year.

Not only have offline retailers moved towards omni-channel retailing, many new online retailers have also been expanding into offline outlets in physical retail space as showrooms and “click & collect” points. In order to survive in a market with a large number of future retail supply in the pipeline, retail developers will need to embrace the fast-moving technology and create new unique selling points for their retail centres.